Insights & innovation: The market research technology landscape

- Insights and Innovation An introduction to market research technology

- Insights and innovation Let's talk about automation

- Insights and innovation Market research companies

- Insights and innovation Sample supplier platforms

- Insights and innovation Market survey software

- Insights and innovation Business intelligence platforms

- Insights and innovation Data analysis, visualization, and reporting software

- Insights and innovation Other platforms & providers

- Insights and innovation A final word on the market research tech landscape

An introduction to market research technology

The market research software and technology industry is a thriving ecosystem of organizations dedicated to helping market researchers better understand the world. We warmly welcome you to this in-depth publication, a source for the companies and solutions that are dominating the research technology sector, from data collection to data analysis and from data reporting and visualization to sharing insights across companies and stakeholders.

Why is this important? ESOMAR’s latest Global Market Research Report not only showed that the output of the industry would exceed $130 billion USD this year, but that much of that growth would be driven by the fast-growing tech-enabled sector. Greenbook’s latest litmus test for the insights space, the GRIT report, showed similar trends, with buyers in the sector seeking tools and technologies to deliver on their need for speed, maximizing data value, and data quality - among other things.

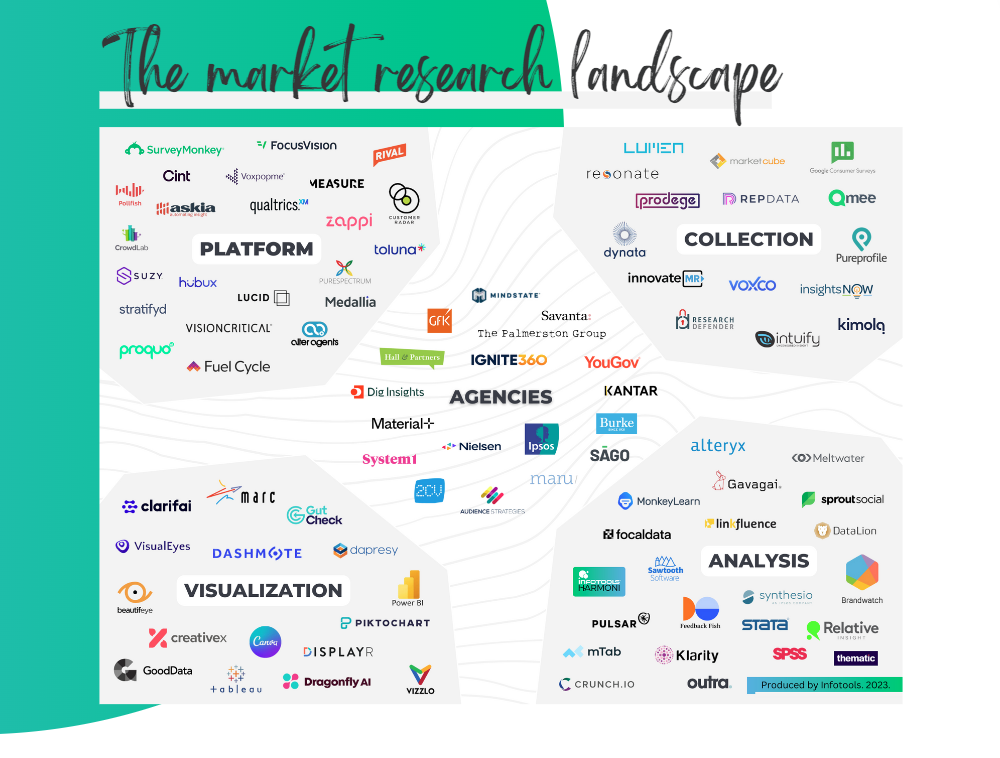

We’d be remiss if we didn’t thank Lucid (A Cint Group company) for its mapping of the industry players in the much-referenced and shared “Research Technology (ResTech) Landscape", part of the inspiration for the image below.

Visually, this image gives just a peek into how many organizations are playing in this sandbox - at every point along the market research continuum. While we won’t cover every player here, it is a solid visualization of the state of this growing, evolving space. Many companies, like Infotools, cross more than one “bucket” as defined in the graphic, but it certainly gives a great place to start.

If we examine the actual mechanics of the industry itself, lines are also becoming blurred between functions. In an environment that has traditionally been separated loosely into silos - find the respondents, collect the data, aggregate the data, analyze the data, create a report, share that report - many companies are now straddling these functions due to a need for centralization and simplicity, mergers and acquisitions that span the research supply chain, new technology implementation, and more.

A good example of this is Forsta, born from the merger between Confirmit and FocusVision, which has now beefed up its platform offerings to run the gamut from a wide number of data gathering tools all the way to reporting and automated insights sharing. After this, Forsta itself was acquired by Press Ganey, providing a good example of the intense M&A activity that is transforming the sector.

On the other hand, there are companies that continue to innovate from within, drawing on industry expertise and marketplace demands to create solutions. For example, Infotools, which was founded more than 33 years ago as an integrated solution for data investigation, visualization and sharing, has the backing and investment of global powerhouse Ipsos. While this enduring vision has been transformed via innovation and new technology over the decades, the company continues to refine this vision of helping researchers get the most out of their data.

If you need advice in your search for new market research technology, we'd be happy to discuss. Just reach out.

Supporting content

Ant Franklin

CEO, Infotools

linkedin.com/in/antfranklin

@antfranklin99

Let's talk about automation

At its core, automation is simply facilitating a task in such a way that essentially does away with human input. There is a perception that to do this one must utilize innovative technology, such as generative AI, but this is not always the case. We're starting this paper with a note on automation because, when done well, it can be far more effective and reliable than the entrepreneurial use of newer technologies.

At a fundamental level, the power behind the ResTech 'movement' is quite definitely automation. The pursuit of automation, which can include artificial intelligence, has permeated every aspect of the industry as demand continues to squeeze research teams to deliver on what has become the mantra of our space: “faster, better, cheaper.”

Automated survey programming and design, and applying automation to data analysis and reporting, are part of the fabric of our industry today. The complex data collection piece, including finding respondents, conducting and managing fieldwork, and more, has been scrambling to catch up, with platforms like Cint working toward automating the process of accessing respondents and gathering data.

At Infotools, we like to think that automation can play a key role in the three main areas of market research.

Problem definition,

research design

Typically carried out by corporate research teams with agency consultation.

Data

collection

Typically carried out by suppliers with input from agencies and corporate research teams.

Data shaping,

investigating, sharing

Typically carried out by agencies but moving toward corporate research teams.

At its core, automation is simply facilitating a task in such a way that essentially does away with human input. There is a perception that to do this one must utilize innovative technology, such as generative AI, but this is not always the case. We're starting this paper with a note on automation because, when done well, it can be far more effective and reliable than the entrepreneurial use of newer technologies.

At a fundamental level, the power behind the ResTech 'movement' is quite definitely automation. The pursuit of automation, which can include artificial intelligence, has permeated every aspect of the industry as demand continues to squeeze research teams to deliver on what has become the mantra of our space: “faster, better, cheaper.”

Automated survey programming and design, and applying automation to data analysis and reporting, are part of the fabric of our industry today. The complex data collection piece, including finding respondents, conducting and managing fieldwork, and more, has been scrambling to catch up, with platforms like Cint working toward automating the process of accessing respondents and gathering data.

At Infotools, we like to think that automation can play a key role in the three main areas of market research.

A closer look at the ResTech ecosystem

As we’ve said, ResTech companies generally don’t fit neatly into categories. Innovative by nature, many of these companies have solutions and offerings that address multiple pain points along the research project process. For the sake of this piece, we’ve attempted to follow a loose categorization to help to organize information in a meaningful way. See below for an overview of key leaders in specific segments of the typical market research process.

Market research companies

These are the firms that drive the market research process from start to finish, employing various ResTech resources along the way to best serve their end clients. Generally, these agencies have in-house technology resources or contracts with outside vendors, with expertise in a specific area, to handle gathering and analyzing data from the desired target audiences - whether it be consumers, competitors, business professionals or other actors in the marketplace.

Companies in this sector are feeling acute pressure from their clients to achieve the promise of “faster, better, cheaper” - and many know that employing the right technology is the path to success in these arenas. While they basically need the tools to do the heavy lifting and eliminate time-consuming manual tasks via innovation, they are also aware that clients are eye-balling technology “bells and whistles.” The most recent GRIT Insights Practices report indicates that there is a significant percentage of buyers or clients who are interested in exploring “future-forward approaches” like AI, chatbots, crowd-sourcing, eye tracking, neuroscience, and others.

In fact, agencies are facing a bit of a challenge as ResTech becomes more ubiquitous and accessible, with some concerns that clients will bring functions in-house using new technologies. According to ESOMAR’s GMR Report (2022), the number of projects clients are handling in-house is steadily on the rise, creating a need for agencies to pivot their models and focus on where they can play to their own strengths in the new ecosystem. Agility and flexibility are key, while displaying the ability to bring together all the right tools, techniques, methodologies and ResTech functions to help clients achieve their goals.

GfK

GfK is a global market research company that offers a comprehensive suite of research and consulting services. It specializes in providing insights on consumer behavior, retail trends, and market dynamics across various industries. GfK utilizes a mix of data collection methods, including surveys, point-of-sale data, and consumer panels, to deliver actionable insights and support strategic decision-making for businesses. ESOMAR

Hall & Partners

Ipsos

Kantar

Nielsen

Market research firms

For this section, we focus on some of the biggest agencies in our industry, sorted alphabetically: there are far too many to list that are using technology in interesting ways, applying specialized expertise in specific sectors and providing a high level of strategic service to end-clients of every ilk.Sample supplier platforms

Whatever you call businesses that fall into this category - online marketplaces, panel providers, sample suppliers, data collection companies - this is one of the most competitive sectors in the ResTech landscape. With crucial challenges like data quality falling under their purview (whether by reality or perception), plus an increasing need for engaged respondents who are highly targeted and profiled, sample suppliers are key players in the ResTech landscape.

In fact, the "ResTech" designation itself is rumored to have been coined by Lucid in 2020, in an attempt to define “the software and tools that help platforms, agencies, and brands target, deliver, and analyze their insights initiatives.”

Generally, the tasks that fall under these businesses include managing the sampling and data collection portions of market research projects. They give researchers access to a large network of survey respondents, who can be targeted for specific studies based on profiling points, in addition to handling the fieldwork itself.

Most offer a variety of options for customers, such as self-service/DIY platforms, managed services, or even API integrations with panels for seamless access to respondent pools.

In addition, fraud mitigation techniques and technology are generally employed throughout the process to help improve data quality.

While this may sound fairly straightforward, this portion of the market research process is inherently complex and was extremely difficult and time-consuming before widespread technology implementation. Lack of standardization, the need for a greater pool of diverse respondents, and the ever-present demand for faster processes has forced this sector to innovate using automation and other technologies.

Like many other segments of the ResTech landscape, sample companies have identified opportunities to expand their offerings beyond supplying respondents. Many claim to offer “end-to-end” platforms, handling more and more steps of the market research process, either by integrations with other companies or new technologies built in-house.

As the regulatory landscape changes, due to privacy laws, loss of cookies and crackdowns on tracking by large players like Apple and Google, some of these companies, like Cint, are using their access to large respondent bases to help connect data for things like media measurement and attention metrics.

Cint (Lucid)

Cint, which acquired Lucid in 2022, is a market research technology company that specializes in providing solutions for online sample management, programmatic sampling, and data insights. The company offers a platform that connects researchers with a diverse pool of global respondents, facilitating the collection and analysis of consumer insights for market research purposes. Cint offers data connection and media measurement capabilities that enables businesses to make data-driven decisions. Insight Platforms Capterra

Dynata

Dynata provides first-party data survey and research respondents through an extensive, global network of panelists, allowing clients to collect insights on their target audiences. The company provides a wide range of services, including survey programming, advertising effectiveness measurement, brand tracking, and data enrichment - all meant to automate the market research process at every step. Insight Platforms Capterra

Rep Data

Respondent.io

Toluna

Sample supplier platforms

Whatever you call businesses that fall into this category - online marketplaces, panel providers, sample suppliers, data collection companies - this is one of the most competitive sectors in the ResTech landscape. Again, we have ordered these sample suppliers alphabetically.Market survey software

Survey software is a category with significant “creep” into other segments. Twenty-plus years ago, moving surveys online was a huge innovation with companies like SurveyMonkey (founded in 1999) practically becoming household names. Over the decade that followed, the market research industry as a whole was scrambling to catch up with the rapid pace of technology, and had a reputation of being slow to innovate - a reputation which it has, for the most part, shaken off in the past several years.

That said, online survey platforms stood alone for years providing a bridge for researchers to make the huge leap from CATI and paper methods to more efficient and effective online techniques. There was always more work to be done, from improving respondent experiences overall to mobile-first designs, keeping survey software companies on their toes. This environment kept them firmly ensconced in the “survey software” camp, which has ultimately defined their place in the market research ecosystem.

Today, many of these companies offer much more than simply designing and launching surveys. For example, Qualtrics, which was early to the game in 2002, has evolved over the decades and redefined itself as an “experience management” company, integrating advanced analytics functions into its offerings, as well as providing solutions for other industry verticals, such as human resources and product development.

Decipher, one of the leading survey companies, was acquired by FocusVision in 2015, but retained its recognizable brand. In 2021, Forsta was born from a number of large mergers representing leading brands in the industry, including FocusVision, expanding offerings far beyond survey software. We focus on just their legacy survey offering, Decipher, below.

Alchemer

Alchemer, formerly known as SurveyGizmo, is a survey software platform designed for market research and customer feedback. It offers a range of survey question types, customizable templates, and advanced reporting capabilities. Alchemer emphasizes flexibility and automation, allowing researchers to create surveys, collect responses, and analyze data to uncover insights that drive business growth and improve customer experiences. Insight Platforms Capterra Software Advice SelectHub G2

Askia

Decipher (Forsta)

Qualtrics

SurveyMonkey

SurveyMonkey is a popular online survey software that allows users to design and distribute surveys for a variety of research purposes. It offers a user-friendly interface and a range of survey question types, along with features for data analysis and reporting. SurveyMonkey aims to make survey research accessible to users of all levels of expertise, providing a platform for gathering insights and making data-driven decisions. Insight Platforms

Market survey software

Online surveys have taken a huge leap forward in recent years, and this has become a very competitive space. The introduction and impact of new tech like generative AI will be interesting to track with these organizations. This section has also been sorted alphabetically.Business intelligence platforms

When we think of BI tools, the ubiquitous Tableau and Power BI immediately come to mind although there are other players in this space, such as Qlik, Looker by Google, SAP, and even Oracle. While these platforms don’t technically belong in the ResTech conversation, because they are not primarily fashioned for market researchers, they are indeed used widely by research teams that are constrained by the parameters of their corporate IT departments.

One strength of these types of business intelligence tools is their wide-ranging capabilities for ingesting, processing and reporting on data. However, they aren’t a perfect fit for all kinds of data, and have significant limitations surrounding the examination of weighted data, data hierarchies, significance testing, statistical testing, processing multi-response questions, or building metrics on the fly.

Those using these types of tools for market research have perfected the art of workarounds that address the shortcomings the tools have in processing complex primary research data. But it costs them precious time and money, plus there can be personnel risks associated - especially if key people change roles or organizations.

Oracle Business Intelligence

Oracle Business Intelligence Suite is a cloud-based solution that helps small to large enterprises gain insights into organizational performance using predictive analytics for decision-making. The centralized platform comes with an administrative dashboard, which enables users to collect content from multiple data sources and modify generated results. Capterra Software Advice Select Hub G2

Microsoft Power BI

Qlik Sense

SAP BusinessObjects

Tableau

Business intelligence platforms

In this section we summarize the top five business intelligence tools by global revenue (listed alphabetically). While these platforms span multiple categories in the technology landscape, many researchers are forced to use them for their complex data streams so they are worth examining a bit more closely.Data analysis, visualization, and reporting software

As the industry moves swiftly toward the elimination of silos in the market research process, the data integration, analysis, visualization, reporting and sharing steps just make sense as a complete package. While there are companies that specialize in just the data analytics or just the visualization pieces, here we will focus on those who have, either by design or accident, ended up with a business model that encompasses all of these steps in the process of uncovering and delivering insights.

To provide a general overview of the functions in this category, we see many of these companies offering tools that ingest data - whether from surveys or other business data streams - and integrate it into a usable data set. Technology is then wielded to analyze the data, providing techniques and processes that make it easier for researchers to explore data, find the top insights, and create reports more quickly.

Visualization is a key part of these companies’ offerings, providing graphic and visual elements so that the insights and data are easy to understand and share with others. These steps, when performed manually at any point in the process, can be very time consuming and delay access to insights. Implementing efficient, effective technology across these steps is vital in delivering value. In fact, when it comes to the reporting stage, and sharing insights, ESOMAR’s GMR report says “this is an essential part of the cycle where intelligence is finally shared with clients” to create strategies. Our ultimate job as researchers!

While the paths to get there varied widely, the companies in this sector all saw the same need: to deliver insights that kept up with the increasing pace of business across all sectors. A sticking point at any step of the process would delay the entire operation, thus the analysis, visualization and sharing functions landed, eventually, under one umbrella.

Crunch

Crunch is a self-service survey data analysis and delivery platform that offers market researchers and insights professionals a way to analyze, visualize, and deliver insights in a secure, cloud-based environment. The company’s self-service model highlights collaboration, searchability of all data stored in the platform, and drag-and-drop user interface. Insight Platforms Greenbook

Dapresy (Now Forsta Visualizations)

DisplayR

Infotools (Harmoni)

KnowledgeHound (YouGov)

KnowledgeHound is a search-driven analytics platform that helps organizations centralize, analyze, and visualize their market research data. The company provides tools for data aggregation, search, and visualization, enabling users to explore and leverage insights from multiple research studies. It focuses on natural language searches that can be used to analyze data and discover new insights, tagging studies and organizing them in a “Pinterest-like” wall. Insight Platforms Capterra G2 Greenbook

MarketSight

MarketSight focuses on enabling researchers to analyze, visualize, and share market research data. Its platform offers advanced data analytics features, including statistical analysis, cross tabs, data visualization tools, and tools to help share reports with others. MarketSight also offers professional services, allowing clients to access experts in analytics, design, and engineering to help them gain actionable insights from their data. Insight Platforms Capterra SelectHub G2

Data analysis, visualization, and reporting software

This section is where the rubber hits the road from an insights perspective. All the fieldwork and data collection has been completed. Now it is time to start investigating the market research data through both statistical analyses and visual exploration. Once this is done, concise, engaging, and interactive reporting helps stakeholders to take appropriate action in their organization.Other platforms & providers

If one thing has become clear in writing this guide, companies in the ResTech industry defy neat categorization. On our podcast, we’ve been lucky enough to speak with innovative leaders who are pursuing the use of technology to solve challenges in market research, whether it be providing better behavioral data, natural language processing, fraud mitigation and more. Some of these companies are outlined on the following pages.

HubUX

HubUX is a research operation platform for private panel management, DIY recruitment and qualitative automation. The company’s tool bridges participants and researchers, providing a fully-customizable panel and community management solution, with full-service recruiting, screening and end-to-end qualitative solutions. In 2022, HubUX was acquired by VoxPopMe, a software platform that allows customer conversations at scale with real-time, consumer-recorded video feedback. Insight Platforms G2

Immersion

Measure Protocol

Measure is a consumer intelligence company that takes the pulse of the digital consumer, providing on-demand access to authentic behavioral data for making informed product and marketing decisions. Using proprietary digital behavior detection technology and machine learning, the company captures digital consumer behavior and converts their permissioned digital data into easily digestible data sets via its newly launched Measure Platform. Measure delivers insights into consumer daily habits, emerging trends and factors of influence in a fully-compliant environment. ESOMAR Insight Platforms

Relative Insight

Research Defender

Thematic

Other platforms & providers

In this section, we highlight a few organizations that don't quite fit into the categories we have outlined earlier in the paper. Additionally, these organizations are either making waves in the industry, have worked with us in some capacity, or are offering an interesting alternative to what is currently out there. Ordered alphabetically.A final word on the market research tech landscape

As we have always maintained at Infotools, it is crucial to balance the use of technology with human expertise and judgment. This remains true with the use of AI, which should be seen as a complement to human researchers, empowering them with powerful tools and insights. As AI techniques become more prominent in the ResTech landscape, we must find our “techquilibrium” among the pillars of technological capabilities, human expertise, and ethical considerations.

The ResTech ecosystem evolution is ongoing, driven by both new technology advancements and ongoing marketplace demand for the trifecta of speed, accuracy and cost-effectiveness. As long as brands, agencies, data collectors, and software vendors focus on delivering the fundamentals of market research, we can see a very exciting future ahead of us. We can’t wait to see what’s next.

The space to think series

Infotools was created by curious market researchers who wanted to uncover new ways to better understand the world. And we’re still just as curious. We’re acutely aware of how deep insights require time, and can’t be rushed. That’s why everything we do at Infotools is dedicated to giving market researchers more space to think. We trust this and other papers in this series will do just that. If you’re interested in other publications in this series, feel free to check them out below.